International bank transfers. For a freelancer or small business owner, those three words can bring on a mild sweat. You’ve done the work, you've sent the invoice, and now you’re staring at a payment form with a blank field labeled: SWIFT/BIC Code.

Panic sets in. What is that? Where do I find it? Is this going to delay my payment for another week? I’ve been there. I once spent the better part of an afternoon trying to find the right code for a new client in Germany, navigating a clunky bank website that felt like it was designed in 1998. It was... frustrating.

That’s why I’m always on the lookout for simple tools that solve these annoying little problems. And recently, I stumbled upon a site called My SWIFT Codes. It’s a clean, no-nonsense SWIFT and BIC code database, and frankly, it’s exactly what I needed all those years ago. So, let’s talk about it.

So, What Even IS a SWIFT Code Anyway?

Before we get into the tool, let's clear this up. Think of a SWIFT code as a postal code for your bank on a global scale. It’s a standardized code that tells banks exactly where to send money internationally. Without it, your money is basically floating in cyberspace with no directions.

You’ll often see it called a BIC (Bank Identifier Code). For all practical purposes, SWIFT and BIC are the same thing. SWIFT (Society for Worldwide Interbank Financial Telecommunication) is just the organization that manages these codes. So don't get hung up on the terminology. The code itself is usually 8 or 11 characters long, a mix of letters and sometimes numbers that identifies the specific bank, country, city, and even branch.

Sounds complicated? It is. But the good news is you don’t need to be an expert decoder. You just need a good lookup tool.

Putting My SWIFT Codes to the Test

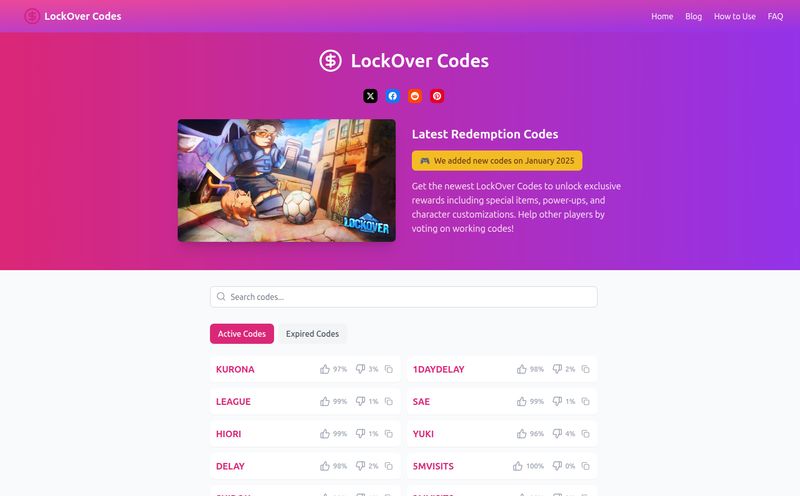

The first thing I noticed when I landed on the My SWIFT Codes website was the simplicity. There are no distracting pop-ups, no flashy banners, just a big, beautiful search bar right in the middle of the page. You love to see it.

The process is exactly as you'd hope. You can start typing a bank's name or a country, and it helps you narrow it down. For example, I typed in "Bank of America" and selected the United States, and boom—it gave me the primary SWIFT code, along with the address. No fuss.

Visit Bank SWIFT Codes & BIC Codes Database | Lookup tool

It also has a neat "Initial Letter Quick Check" feature, which lets you browse banks alphabetically. It’s a small touch, but it’s useful if you’re not 100% sure on the spelling of a foreign bank. The whole experience feels designed for speed and getting you the information you need so you can get on with your day.

Features That Actually Matter

A tool can be simple, but it also has to be useful. My SWIFT Codes has a few features that I think make it stand out from just a basic search engine.

It Knows More Than Just SWIFT Codes

This was a pleasant surprise. The site also provides information on domestic bank codes for different countries. This is huge. If you've ever tried to get paid from India, you know they use an IFSC (Indian Financial System Code). For transfers within the UK, you need a Sort Code. The US has its Routing Numbers. This tool has information on those, too. Having that all in one place saves you from having to open another five tabs to figure out what your client is asking for. Its a real time-saver.

Multi-Language Support

The website is available in several languages, including Spanish, French, Chinese, and German. As someone who works with clients all over the world, I appreciate this. It shows a genuine understanding of its global user base. It’s not just an English-centric tool pretending to be international.

The Built-in Code Checker

It’s one thing to find a code, it's another to be sure it's correct. The site has a checker tool to validate a SWIFT code. This is great for peace of mind. Sending a large sum of money with a single digit wrong in the code is a recipe for disaster—a disaster that can cost you time and sometimes, processing fees to fix. A quick check here can prevent a lot of headaches.

The Good, The Bad, and The Price Tag

Alright, let’s get down to it. No tool is perfect, right?

The main upside here is obvious: it's incredibly straightforward and it’s completely free. There’s no sign-up, no email harvesting, no “premium” version hiding the best features behind a paywall. In a world where every service wants a monthly subscription, a genuinely useful and free tool is a breath of fresh air.

Now for the caveats. Because it's a massive database, it might not have every single small-town credit union or a newly established regional bank. For the major players—your HSBCs, Chases, and Deutsche Banks of the world—you’re golden. But if you’re dealing with a very niche financial institution, you might still need to do some extra digging. Also, the tool relies on you entering the information correctly. Garbage in, garbage out, as they say. A typo in the bank name could send you down the wrong path, so always double check your spelling.

But Can’t I Just Google It or Ask My Bank?

Some might argue that you can just find this information on your bank's website. And you probably can. Eventually. But have you tried it? Big corporate bank websites can be a labyrinth. You'll likely click through five different menus, a confusing FAQ page written in corporate-speak, and maybe, if you're lucky, find a page that lists one of their 15 different SWIFT codes.

This tool is about convenience. It’s the difference between asking Siri for the weather versus turning on The Weather Channel and waiting for your local forecast to come on. Both get you the answer, but one is a heck of a lot faster.

Frequently Asked Questions

1. What is the difference between a SWIFT code and a BIC code?

There's no real difference for the end-user. They are essentially the same thing. BIC (Bank Identifier Code) is the official term, and SWIFT (Society for Worldwide Interbank Financial Telecommunication) is the organization that oversees the system. The terms are used interchangeably.

2. Is a SWIFT code lookup tool like this safe to use?

Absolutely. These tools are just directories of publicly available information. You are not entering any personal bank account details or passwords. It's as safe as using a phone book.

3. Are SWIFT codes the same as IBANs?

No, they are different but often used together, especially for transfers to Europe. An IBAN (International Bank Account Number) identifies an individual account, while the SWIFT code identifies the specific bank. You often need both for a successful transfer.

4. How can I be 100% sure the SWIFT code is correct?

While a good lookup tool is highly reliable, the gold standard is always to confirm the details with the recipient or their bank directly. A quick email to your client or contact asking them to verify the details is a smart move before sending any money.

My Final Thoughts

Look, making and receiving international payments can be a needlessly complex part of doing business. Any tool that shaves off some of that complexity is a winner in my book. My SWIFT Codes is exactly that—a simple, effective, and free resource that does one job and does it well.

It’s not going to revolutionize your entire workflow, but it will solve a very specific, very annoying problem in about 30 seconds. And sometimes, that's all you need. It has earned a permanent spot in my bookmarks folder. So next time you're staring down that SWIFT/BIC field on a form, you'll know exactly where to go. Happy transferring!